July 14, 2025

Global Energy Insight team

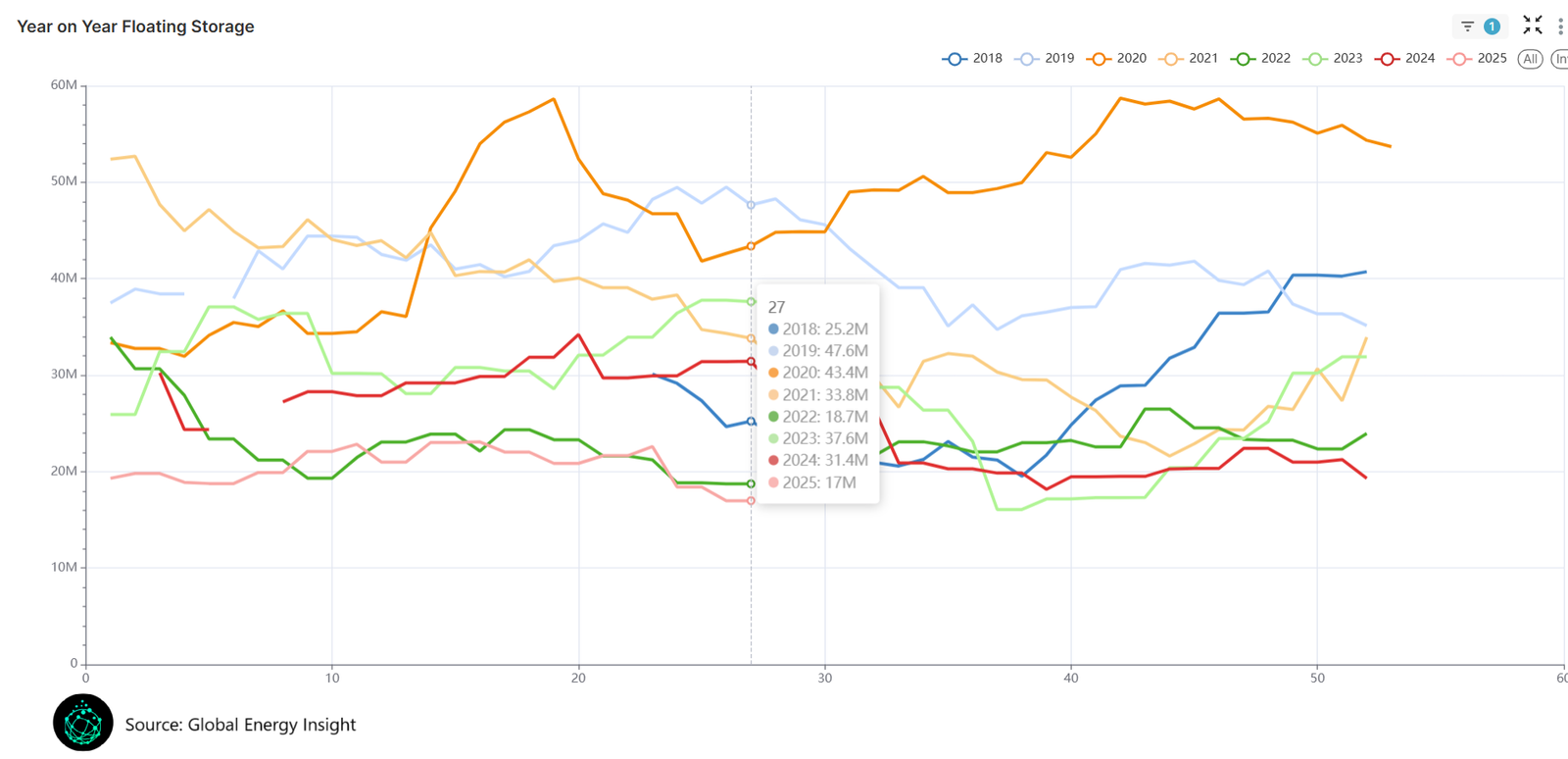

Cushing Crude Stocks Build Slightly in July, But Inventories Remain Seasonally Low

U.S. Energy Information Administration (EIA) data released for the week ending July 4 indicated that crude oil stocks at Cushing, Oklahoma, rose modestly, bringing total inventories to approximately 21.2 million barrels. Despite halting recent drawdowns, storage levels at the WTI delivery hub remain near the bottom of their historical range, signaling an ongoing squeeze on domestic onshore supply.

Current Inventory Snapshot

At around 21.2 million barrels, Cushing holds just over one-fifth of its approximately 94–98 million barrels (per EIA shell data). This proportion was last seen during the 2014–2015 troughs when stocks dipped to around 20 million barrels, the lowest level in more than a decade. Compared with mid-summer 2024, when inventories exceeded 30 million barrels, this represents a year-on-year decline of nearly 40%. Such thin margins raise operational concerns: floating-roof tanks can encounter pumpability issues, as well as water or sediment contamination, when stocks fall near minimum safe levels, potentially constraining throughput and increasing quality premiums.

Because Cushing is the physical settlement point for NYMEX WTI futures, its inventory swings carry significant price implications. Tight stocks tend to push prompt-month futures into backwardation, reflecting a premium on near-term supply, and widen basis differentials as market participants pay up to secure prompt barrels and avoid logistical bottlenecks.

Tank-Level Perspective

Our Onshore Oil Inventories product uses satellite imagery and proprietary algorithms to track storage data across Cushing’s extensive tank network. Currently, only a select few tanks hold inventories above 60 percent of their working capacity. These include Enbridge-managed facilities in the south terminal, Plains-operated tanks in the central hub, and NGL Energy Partners LP sites in the eastern cluster. Satellite-derived measurements confirm these tanks still hold high liquid levels—evidence of substantial inventory buffers—even as most others continue to draw down. By updating measurements periodically, our platform surfaces these shifts, giving traders and analysts actionable insight into where storage is loosest or tightest within the hub.

Cushing Oil Inventories Outlook

Looking into Q3 2025, Cushing’s inventory path will hinge on the interplay of refinery maintenance, U.S. production trends, export/import balances, and demand patterns. Scheduled autumn refinery turnarounds typically reduce throughput, offering an opportunity for modest stock rebuilds. At the same time, any surge in domestic output or rerouting of pipeline flows into the hub could accelerate replenishment. Conversely, sustained export demand and constrained import volumes will keep stocks lean. On the demand side, a tapering of summer driving demand or broader economic cooling could ease withdrawals, but robust refinery runs suggest continued drawdowns are likely in the near term.

Most market observers anticipate a moderate recovery, potentially lifting stocks into the mid-20 million-barrel range, before winter fuel production ramp-ups drive inventories lower again. Given Cushing Oil Inventories’ role as a barometer for U.S. supply-demand balance, even incremental changes of a few hundred thousand barrels will continue to influence WTI pricing and overall market sentiment. For traders managing spreads or logistics, combining weekly EIA reports with high-frequency, tank-level data from Global Energy Insight’s Onshore Oil Inventories product provides a critical early signal in today’s finely balanced oil market.

See U.S. oil inventories clearly

Global Energy Insight’s Onshore Oil Inventories tracks real-time storage levels across terminals, ports, and refineries nationwide, so you can stay ahead of the market.

Have a question?