August 14, 2025

Global Energy Insight team

Signals of the Mars Crude Zinc Contamination Before Headline Broke

Global Energy Insight tracks the Mars zinc event in the Gulf of Mexico with a lens others haven’t offered: satellite-measured, above-ground storage. Using our Onshore Oil Inventories data, we read the Mars chain in reverse—starting at Anchorage near Baton Rouge, then St. James, then Clovelly—to show how barrels were staged, absorbed, and buffered as the headlines developed. These storage signals illuminate price formation and give traders actionable, time-sensitive intelligence.

Mars Zinc Contamination Recap

An early-July quality scare in the Mars crude stream briefly unsettled Gulf Coast price spreads and flows. A key buyer(ExxonMobil) stepped aside, and a U.S. strategic-reserve exchange steadied refinery runs; testing later indicated conditions had normalized. The timeline below sketches the arc—from late-June strength through mid-July stress to stabilization.

-

Late June 2025 — Mars, a Gulf of Mexico medium-sour grade, traded about $1/bbl over WTI with no reported quality issues.

-

July 8–9 — Traders flagged elevated zinc in the Mars stream; prices swung from a premium to roughly a $0.10/bbl discount. Shell said its contribution tested within specifications. Market sources pointed to an additive on a feeding platform as the likely source.

-

July 10 — ExxonMobil told counterparties it would halt Mars purchases pending a fix, noting risks zinc poses to units and catalysts.

-

July 10–11 — The U.S. Department of Energy authorized an SPR exchange of up to 1 million bbl to Exxon’s Baton Rouge refinery to cover an offshore supply disruption; barrels are to be repaid in kind with interest.

-

Mid-July (July 16) — Exxon resumed purchases for August delivery after a brief pause; Mars was quoted near a $0.30/bbl discount to WTI.

-

July 23 — Chevron said zinc levels were back within expected limits and outlined a testing program with the pipeline operator. Around the update, Mars traded near a $1.30/bbl discount, recovering from earlier lows.

Storage Read: Anchorage, St. James, Clovelly

How we read the barrels. Using Global Energy Insight Onshore Oil Inventories satellite measurements, we track above-ground external floating-roof tanks along the Mars chain in reverse—starting at the affected refinery area (Baton Rouge), then St. James, then Clovelly—to see where inventories built or drew during the event window.

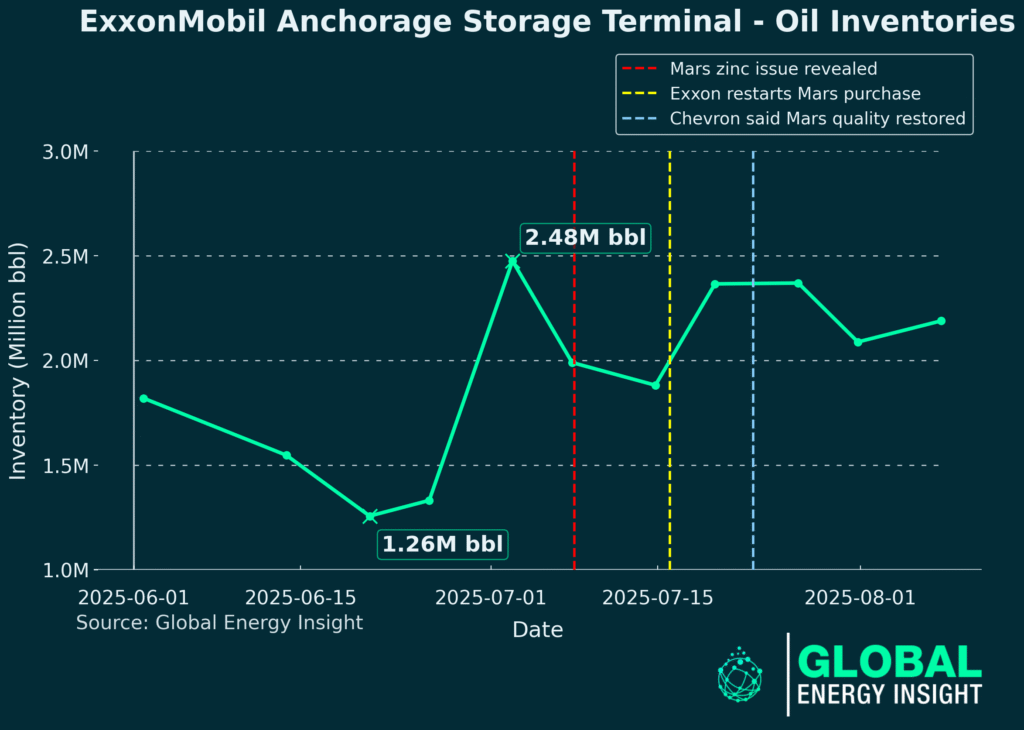

Baton Rouge — Anchorage (ExxonMobil-linked). Before the zinc headlines went public, Global Energy Insight shows a ~+1.20 MMbbl build (Jun 20–Jul 2) at Anchorage, the staging terminal for ExxonMobil Baton Rouge. Anchorage connects back to St. James via ExxonMobil Pipeline’s St. James–Anchorage 16-inch North/South lines (company tariff listings), making it the immediate buffer for refinery runs. ExxonMobil Baton Rouge is one of the nation’s largest refineries (~522,500 b/d).

Why that matters for Mars flows. St. James receives Gulf and imported crude from LOOP’s Clovelly via the 48-inch LOCAP line, so an early-July build at Anchorage is consistent with precautionary staging of Mars-linked barrels moving through St. James—while acknowledging Anchorage can hold other grades as well.

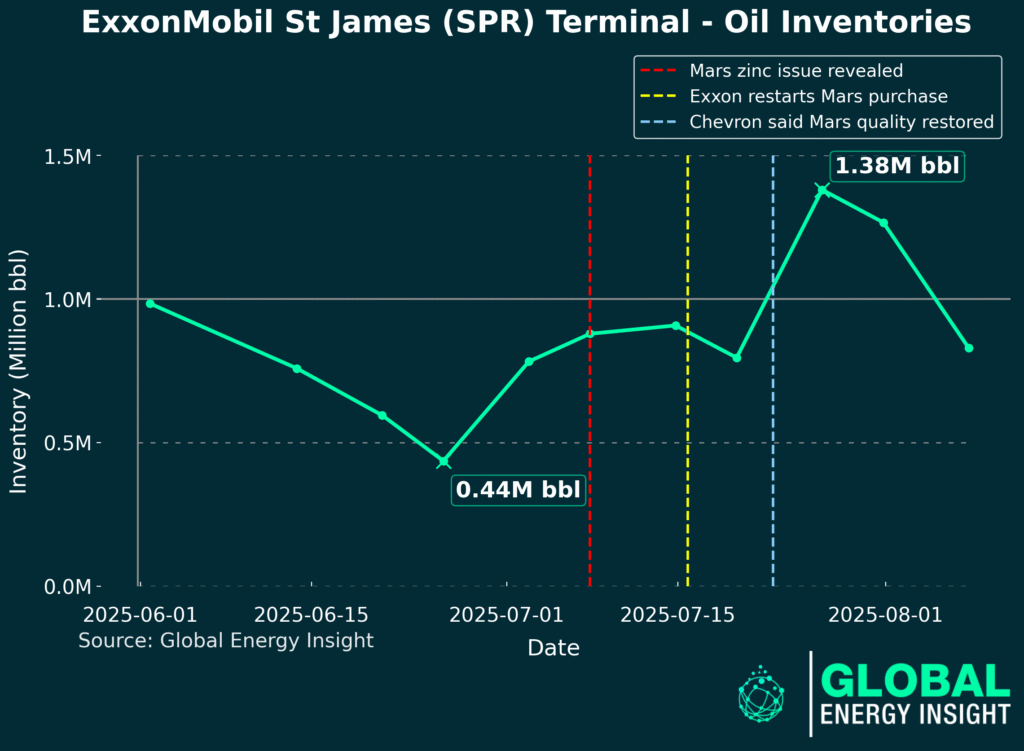

St. James — Exxon/SPR site. Moving one step downstream, Global Energy Insight shows a ~+0.47 MMbbl build (Jun 25–Jul 14) at the Exxon-operated St. James (SPR) terminal, with inventories later peaking near ~1.38 MMbbl on Jul 26 (see chart). Structurally, St. James sits at the crossroads: it receives Clovelly/LOOP barrels via LOCAP and is the southbound receipt for the reversed Capline, and the DOE St. James facility is leased to ExxonMobil with bidirectional connectivity to Bayou Choctaw SPR—making St. James a natural balancing point when quality questions emerge upstream.

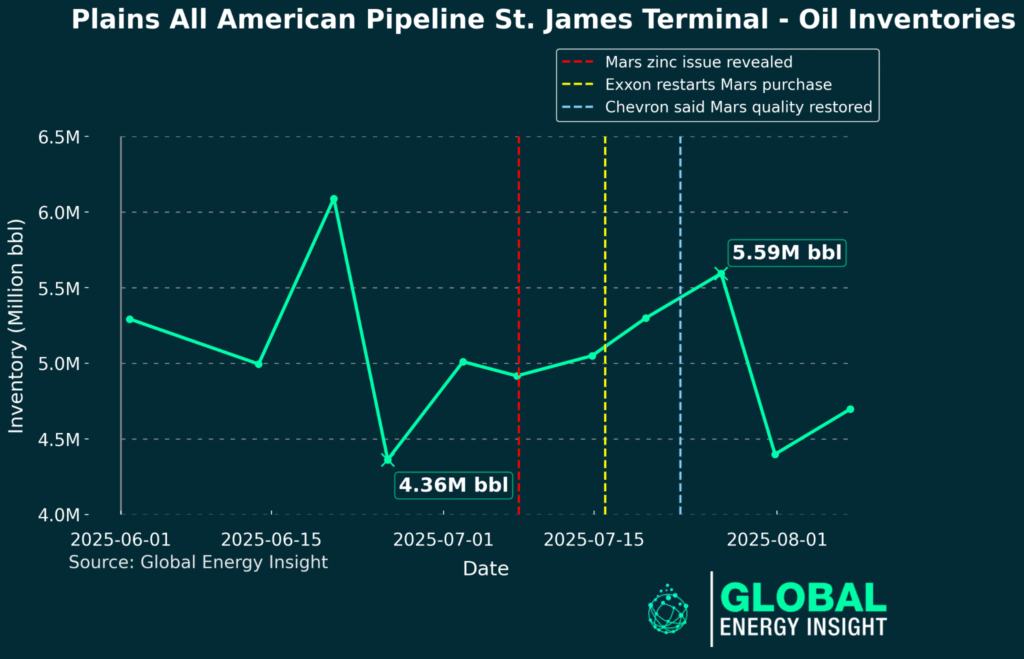

St. James — broader market signal. The response extended beyond Exxon-operated tanks: Global Energy Insight records a ~+1.23 MMbbl build (Jun 25–Jul 27) at Plains’ commercial terminal in St. James—evidence that market participants across the hub positioned barrels during the uncertainty window.

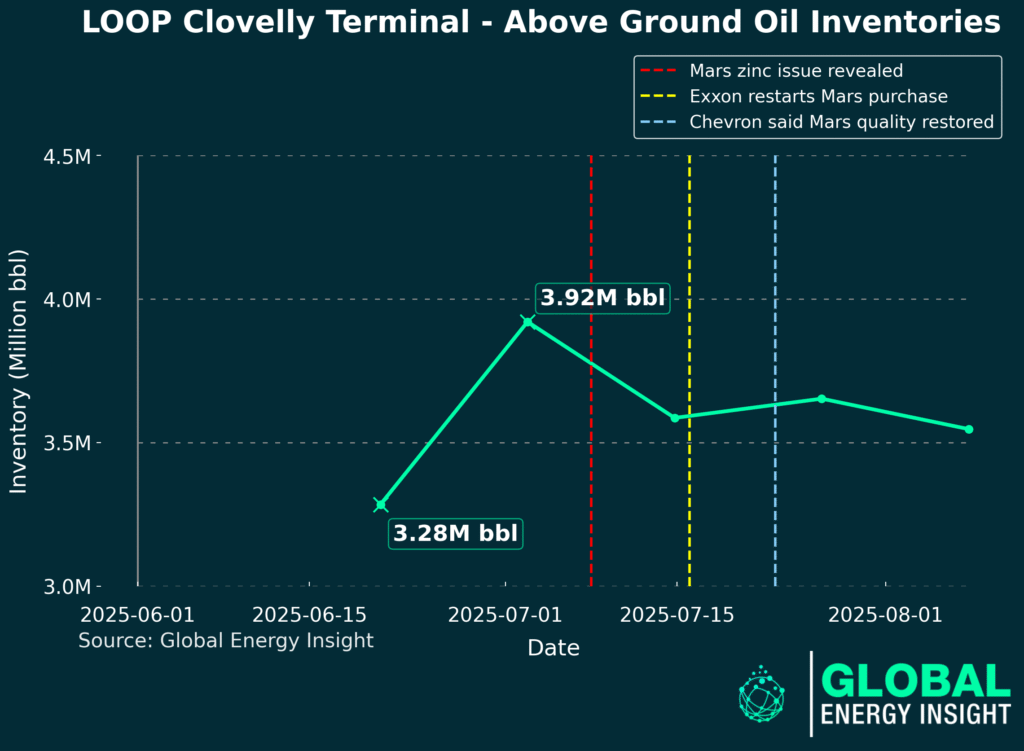

Clovelly (LOOP) — surface signal. Closer to the source, Global Energy Insight shows a modest above-ground build of ~+0.64 MMbbl (Jun 20–Jul 2) at Clovelly. That limited surface move fits Clovelly’s design: most working stock sits in eight salt caverns (≈50–60 MMbbl) with a smaller surface-tank park (~11.5 MMbbl); short-term balancing can occur largely underground. Clovelly receives offshore and shipborne crude at LOOP’s deepwater terminal near Port Fourchon and pushes barrels inland to St. James via LOCAP.

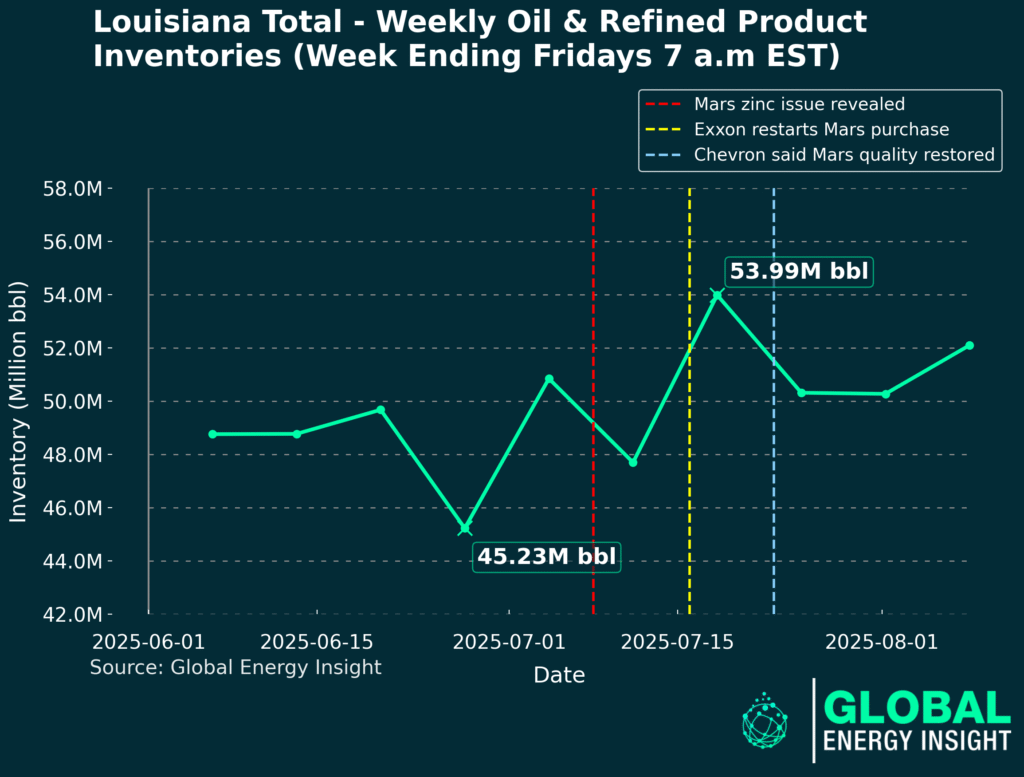

Louisiana statewide signal. Rolling up crude plus products at a weekly cadence, Global Energy Insight totals show ~45.23 MMbbl (week ending Fri, Jun 27) rising to ~53.99 MMbbl (week ending Fri, Jul 18)—a gain of ~8.76 MMbbl across three cut-weeks. That step-up coincides with the public disruption window (Jul 8–23) and the DOE exchange approval; it aligns with precautionary stocking and logistics rebalancing rather than outright demand destruction.

Conclusion

The zinc episode was brief but disruptive. ExxonMobil paused Mars purchases on July 10, resumed August barrels by July 16, and by July 23 Chevron said zinc readings were back within expected limits. The DOE exchange cushioned Baton Rouge during the pinch.

Even after quality normalized on July 23, the Mars–WTI differential stayed unsettled into early August. Discounts that had widened through mid-July narrowed late in the month and then oscillated as buyers recalibrated slates and logistics around the recent quality risk. In that sense, the zinc shock helped catalyze the volatility: precautionary staging, altered crude runs, and timing shifts in liftings kept the spread moving even after lab readings returned to expected limits.

What distinguishes the storage story is how early the barrels spoke. Global Energy Insight picked up staging at Anchorage, parallel builds at St. James (Exxon/SPR and commercial), and a measured surface response at Clovelly—an evidence trail that anchors the price narrative in physical flows and gives traders decision-grade, time-sensitive insight.

Need early storage insights?

Join the waitlist now — see storage data before it hits the headlines.

Have a question?